While you’re making a budget part of your monthly routine, why not pick specific dates for other expenses? You could set up auto drafts out of your checking account to pay your bills.

You can always make adjustments later on. Remember, your budget cuts are only temporary. If things are tight right now, you can save money quickly by canceling your cable, dining out less, and shopping at discount clothing and grocery stores.

Don’t be afraid to trim the budget.īrace yourself! It might be time for some budget cuts in your life. Attack it! Get mad at it! Stop letting debt rob you of the very thing that helps you win with money-your income. Use the debt snowball method and the 7 Baby Steps to get rid of debt as fast as you can. If you have debt, paying it off needs to be a top priority. Once your true necessities are taken care of, you can fill in the rest of the categories in your budget. Giving and saving are at the top of the list, and then comes the Four Walls: food, utilities, shelter and transportation. Start with the most important categories first. And that takes all the fun out of giving and celebrating. When you don’t have a plan, you’re going to be stressed. Make a savings fund you can stash cash in throughout the year. (Hint: Christmas is in December again this year, guys!)īe sure to adjust your budget each month as things change.

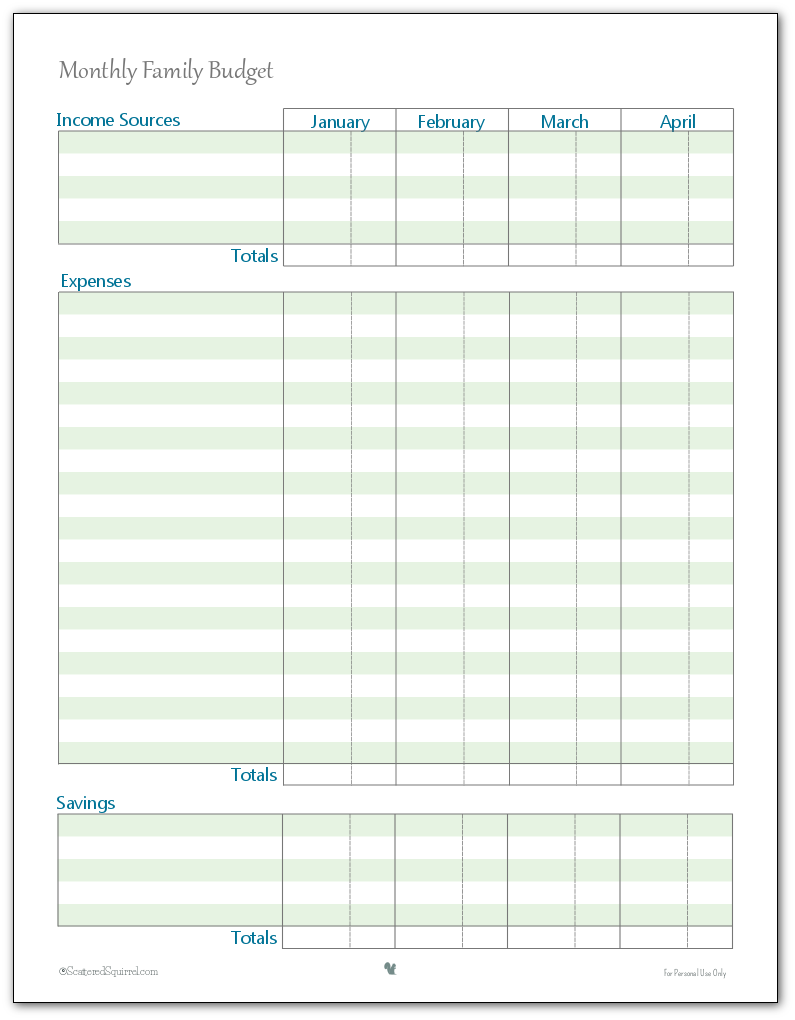

Keep those special occasions from sneaking up on you by pulling up your calendar while you’re creating your budget. Regardless of the occasion, make sure you prepare for those expenses in the budget. Other months you’ll be saving for things like vacations, birthdays and holidays. Some months you’ll have to budget for things like back-to-school supplies or routine car maintenance. Remember: If the two of you are one, your bank accounts should be one too! It’s no longer your money or my money-it’s our money.Īnd if you’re single, find someone who can act as your accountability partner and help you stick to your goals! 3. You need to get on the same page with money, so set goals together and dream about what the future will look like. Make it fun! Grab some of your favorite snacks and put on a good playlist to help you focus. If you’re married, sit down once a month and have a family budgeting night. It just means your income minus all your expenses equals zero. Now that doesn’t mean you have zero dollars in your bank account. This means before the month even starts, you’re making a plan and giving every dollar a name. Ready to get started? Here are the top 15 budgeting tips! 1. How amazing is that? 15 Budgeting Tips for Your Daily Life Many people even say they find "extra" money after they create a realistic budget and stick with it. When you see planning a budget as simply spending your money intentionally, you can actually find more freedom to spend! Once something has been budgeted for, you’ll be able to spend that money without feeling guilty. How Can Budgeting Help Me?Ī budget is going to give you an action plan and clear picture of where your money is ending up each month. Budgeting will help you achieve the goals you’re working toward-whether that’s getting out of debt, saving for retirement, or just trying to keep your grocery bill from getting out of hand. Unfortunately, many people view a budget as a straitjacket that will keep them from doing what they want.īut that couldn’t be further from the truth! A budget doesn’t limit your freedom-it gives you freedom! It’s really all about being intentional with where your money goes. If you have something coming up that you know you’ll need to spend some money on, you could choose to put it on your calendar also.Unfortunately, the word budget has gotten a bad rap. When it all boils down, a budget is just a plan for your money. Budgeting means you’re spending with purpose before the month begins. You aren’t limited to only recording your recurring expenses. Whether to build up an emergency fund or invest in your IRA, mark this on the earlier part of your calendar so you have time to actually do it. If you have a general routine for common expenses, such as buying gas or groceries once every week, you can add them to your calendar as well. List these with the estimated spend, since you won’t know the exact amount.ĭO THIS: Seriously, DO THIS: Include savings as a part of your recurring bills. TIP: Prefer to work your budgets by month instead of year? To make sure you don’t forget about these once-in-a-while bills, make a list of them on a post-it so you can transfer the sticky over easily each month.

0 kommentar(er)

0 kommentar(er)